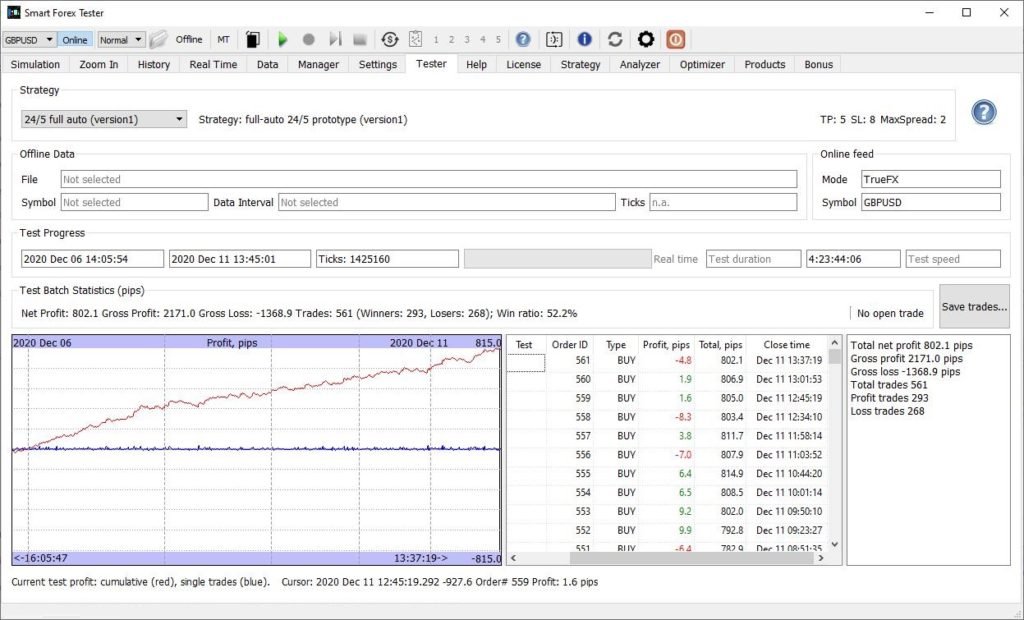

Trading week of December 6-11 was a great success. Our automated trader won 802 pips, which is almost the same that we gained during the whole November.

And again, the most important was how this profit was achieved: smooth growth with low draw-down and no losing days. Win ratio was again stable at 52%.

If you didn’t read our blog before, we have been testing our automated trader software on the real-time GBPUSD data feed by TrueFX. For the details how we are testing, read our previous report.

Here are the weekly results. Total profit was 802 pips.

And if you want to dig deeper, here’s the full trade log.

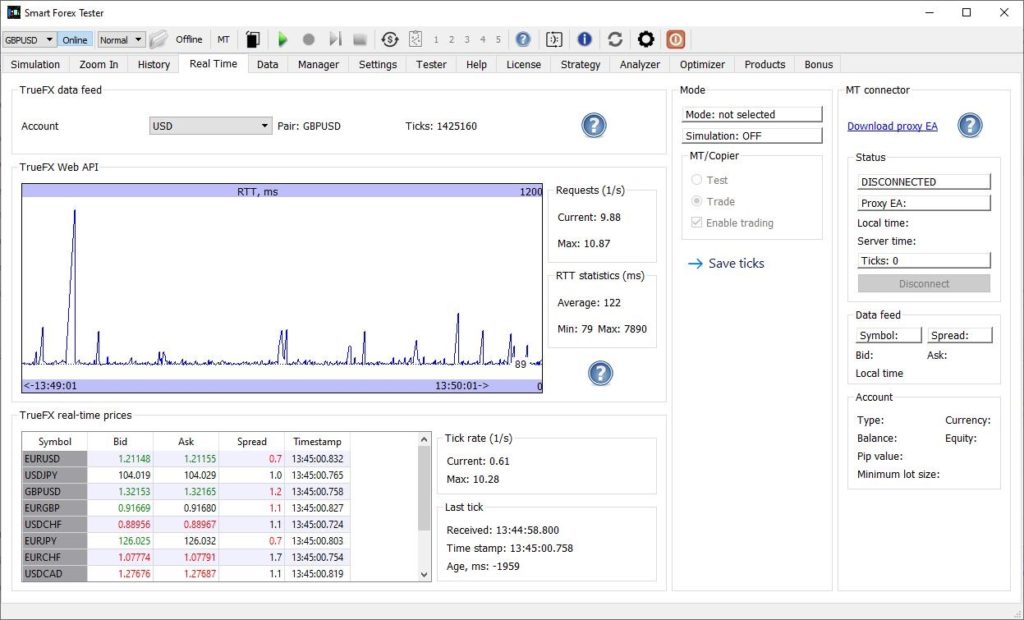

Another important thing we wanted to discuss is the quote server communication.

In this test, we use the free WebAPI provided by TrueFX. The Trader sends the API requests as fast as it can, and gets a new tick in the response every time the server has a new quote.

The software monitors the API request rate, and RTT to the server. See the screenshot below.

We see that the maximum request rate was about 10 requests/s. With the average RTT of 122 ms, it makes full sense: 10 requests requires 10 round-trips. And maximum tick rate was in line, being just a little less than the request rate.

For our test system, the average ping to the server was 12 ms. For another system with the ping of 2 ms, we managed to get average RTT of 15 ms – and max API request rate increased a lot – to just shy of 100 1/s.

However, for the system capable of 100 API requests/s, the maximum tick rate was only about 30 1/s. Which appears to be the maximum possible for the free WebAPI. And a very high value as such.

In yet another test setup with RTT of 150ms the maximum rates were about 5. Still, we didn’t observe the trading performance deterioration in the said test.

We will continue monitoring the influence of the tick rate on the results.