We already mentioned that our tests showed that our strategy is consistently profitable when tested on TrueFX live price feed. And we noticed that one reason for this is much higher tick data rate that TrueFX provides – compared to the feeds from all other brokers that we tested with.

Today we compared the trading performance for 2 different environments – and both were using the TrueFX live feed for GBPUSD.

One setup was using the latest published release that was running on a low-end office laptop.

The other setup was our development environment (IDE). So, it was less optimized than the release version. The IDE machine is a little bit more powerful than the laptop – this is the only thing we need to know hardware-wise. Both machines were connected to the same router.

We started both tests simultaneously about 40 minutes into Sydney trading session on November, 11 and kept it running for 18 hours – through all UK session and half of the US session on November, 12.

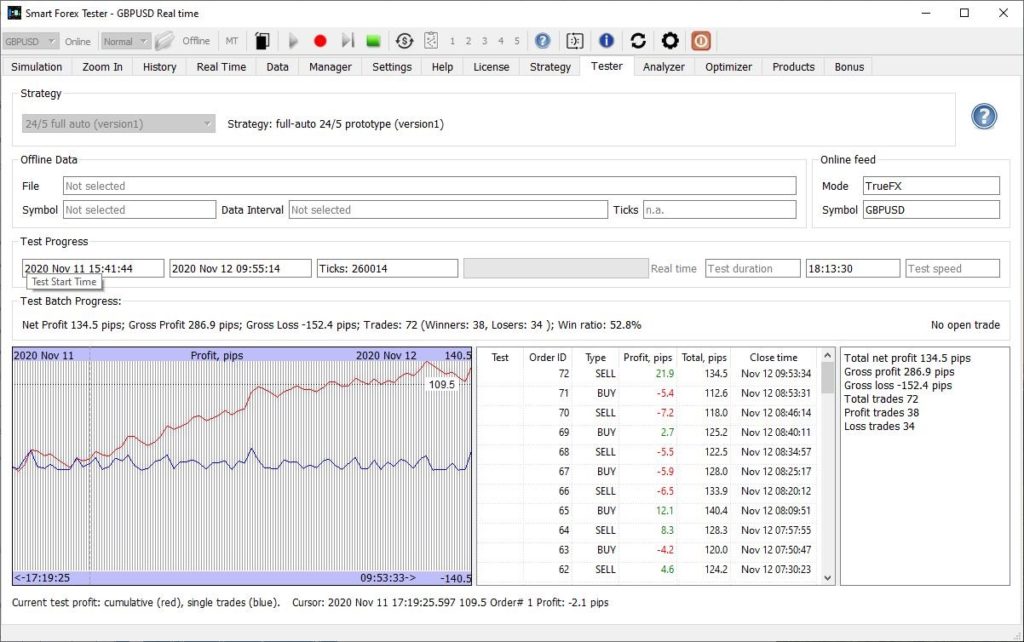

The graph below shows the results from the test run with the release version.

We can gladly notice that the performance was again (!) in line with the test results that we have been getting for last couple of month. Same healthy win ratio and low drawdown.

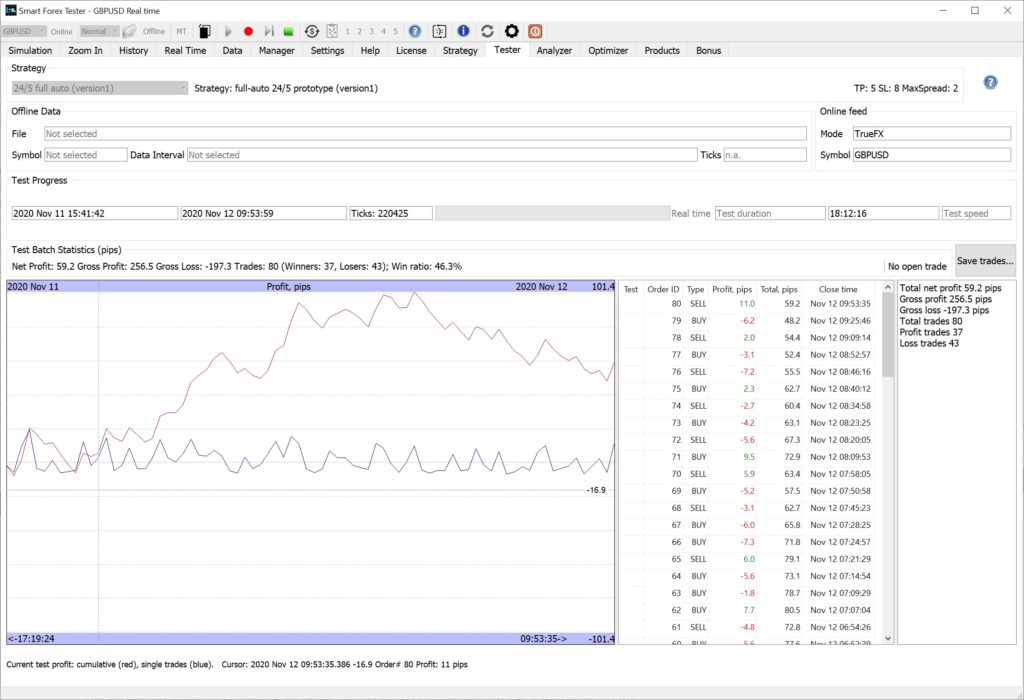

Now, let’s check the results of the test that was run from the IDE. The software in this test is essentially the same as the release. We did implement some improvements, but they don’t affect performance anyhow – while the trading strategy itself and all other trading related code remained unchanged.

We see that while the results are not bad at all in absolute terms, they pale in comparison with the reference test. Why do we have this difference?

We compared the trades for the release with the trades for IDE version.

What we observed was that before the European session started, in slow Asian trading the results match almost 100%. Thus additionally verifying the fact that both softwares works the same.

However, once the market started moving fast in the European session, the results started to differ. And we noticed that the IDE version received ~40K ticks (or 15%) less than the reference release version.

The reason for this difference is clear – less optimized code was not able to handle the same number of quote requests to the TrueFX server.

We can say that 40K is relatively big number. From our experience, from some brokers we could get even less than that – in total!

So, this test confirms our observation we did from the very beginning of testing. Namely, live price feed quality is essential for the success of the strategy.

And we now see that even for the feed that is known to work very well, we can get deteriorated trading performance if parts of ticks are not received.