Bottom line: yet another month our automated trading strategy showed stable profit growth, win ratio exceeding 50% and low draw-down. To achieve such good results, fast quote server connection with RTT around 100 ms was crucial.

In November, we continued testing our automated trader on GBPUSD data feed by TrueFX . Read our previous report for the details of how we did our testing.

Total result was excellent: over 1,000 pips gain. The first week alone gained 514 pips which was the best result, but all the other weeks were also successful – except for the last holiday week where we had a small loss of about 30 pips.

Importantly, at no time did we have big draw-downs; instead the profit was growing steadily and the win ratio was consistently above 50%. In other words, the profit didn’t depend on a small number of mega-trades, but resulted from multiple sequential wins instead.

What is even more important, the pattern mentioned was the same we observed in the previous months of testing. So, this can’t be a coincidence. It shows that our strategy can be trusted even in its prototype version. Which is encouraging.

In addition, we were analyzing how the trading results depend on the quality of the connection to the quote server. We noticed that always when the test machine had higher RTT, it received less ticks and the trading result was worse.

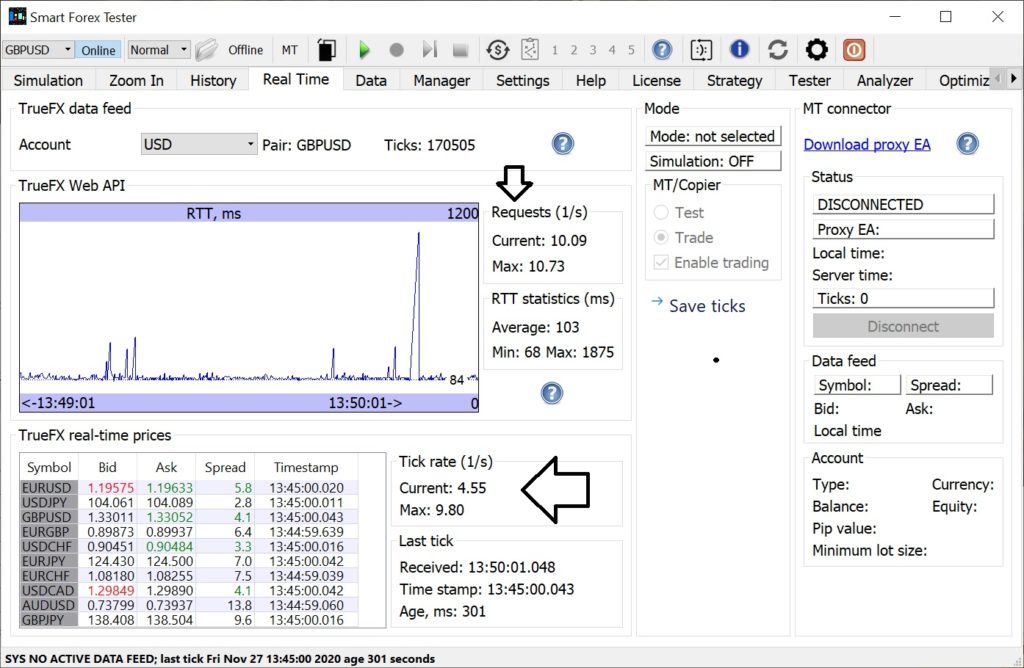

So, we added the functionality to monitor the server connection in the Smart Forex Tester GUI. The below picture shows a sample result from the last 12.5 trading hours in November.

We see that the Tester received over 170K ticks – making the average rate ~3.8 ticks/s. This is higher than what we observed for the brokers we tested with.

But we also see that during the fast moving market we receive ticks even faster – the rate maxed at 9.8 ticks/s. And it is important to notice that the maximum API request rate was even greater – meaning that the server connection itself was not a bottleneck.

Note that the Tester sends API requests as fast as it can, but a request results in a new tick only if the server has an update.

Maximum rate of ~10 ticks/s is excellent. Especially for a free feed. Some providers charge hundreds of dollars a month for such feeds.

So, our testing showed the trader is clearly winning – when run on a high quality tick data feed. Unfortunately, you have to be an institution to trade on excellent TrueFX prices.

A very important next goal is to find a broker providing access to both high quality price feed and execution. So that we can fully realize the potential of our automated trader.

Another task is to improve the trading strategies, since those currently available in the software are only prototypes. With this in mind, the observed performance is amazing.

We have a lot of strategy ideas to implement. One thing we need to address first is to increase the realized win ratio. The tester steadily reports potential win ratio north of 70% – which means the market entries are way better executed than profit taking.

In addition, the version1 that we were testing with is more trend-oriented. With our win ratio of ~50% our profitability mostly resulted from trends. In other words, we win much more when the market was trending, than we lose during the range-bound markets.

Since the markets are range-bound almost 80% of the time, switching the trend-based strategy to the mean reversion based one should definitely increase win ratio.

We can do this simply on time basis: mean reversion should be active after the end of the New York session and at least until the Frankfurt open. Or maybe longer – since sometimes even the London session has a lot of seesawing in the first hour.