We already reported that in our comparative testing the machine with smaller RTT was showing better trading performance. We tried to explain the fact why faster connection and better hardware combination was losing. One of the ideas we had was that if we are sending the requests too fast, the quote server may start throttling.

In order to test this, we swapped the Internet connections. So, we connected the laptop to the router with a Gigabyte Ethernet cable and the desktop was connected via the 2.4 GHz WiFi link. Now, the laptop connection was almost 4 times faster (measured with Ookla speedtest).

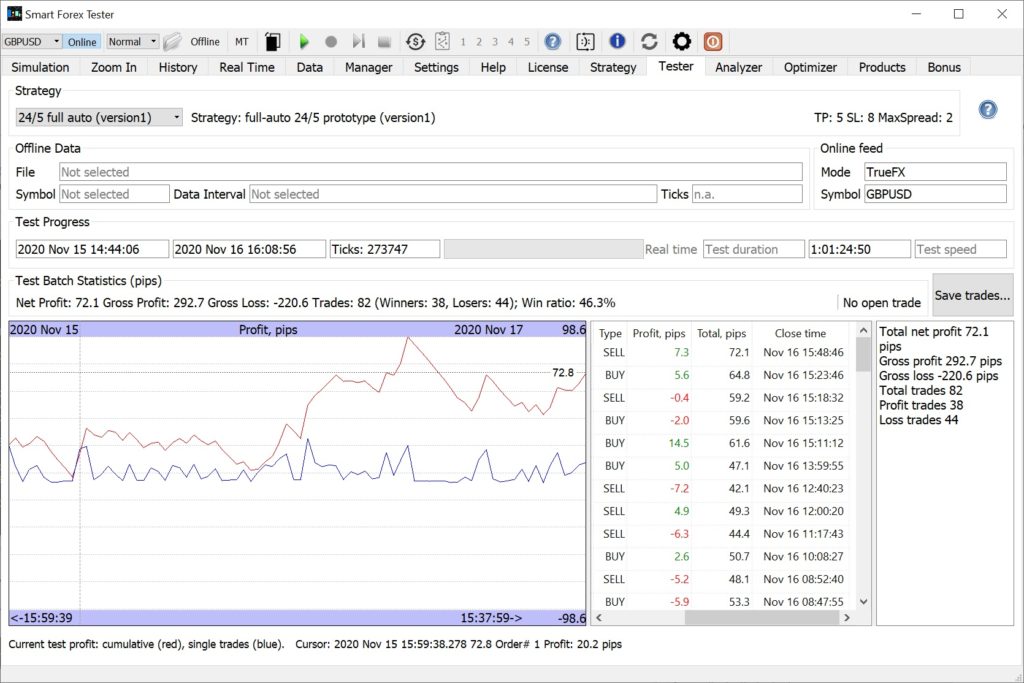

Here are the results. First, the desktop. In 25 hours test it gained decent 72 pips.

Win ratio of 46% was a little bit less than we regularly observed, but still OK. Average RTT was 129 ms and we got nearly 274K ticks. Here is full trade log.

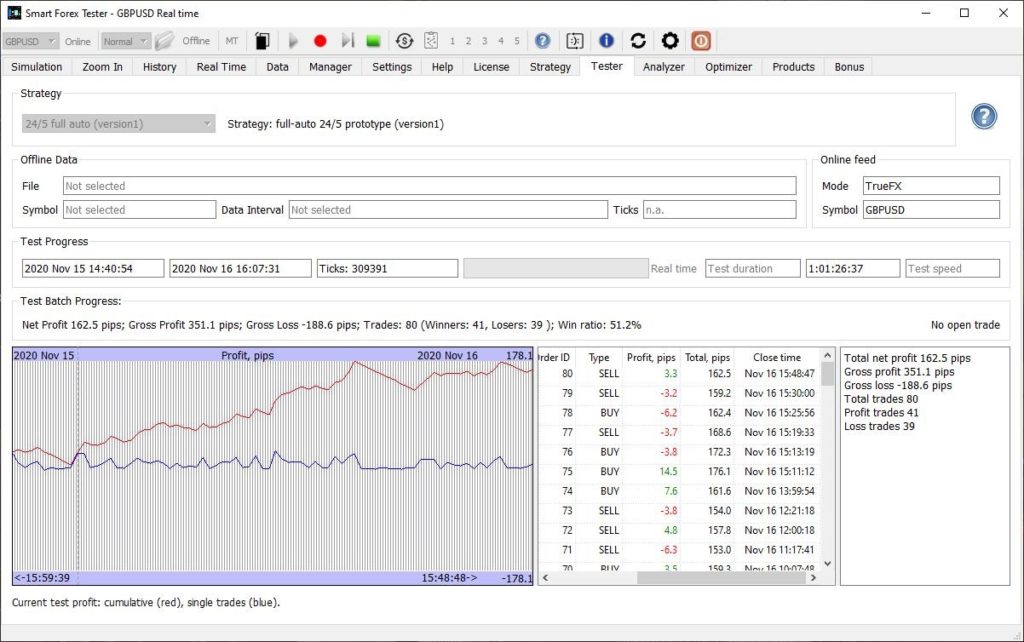

Now, the other test. High connection speed wasn’t a problem at all this time.

Lower average RTT and, correspondingly, 35K (or 13%) more ticks received seemed to help a lot. Profit more than doubled. Here’s full trade log.

So, our hypothesis was wrong – throttling was not at play here. We don’t yet know the real reason. It might be network drivers of antivirus software, among other factors. Again, this is not very important.

But it is important that we again got the confirmation that TrueFX data feed with lower RTT leads to steady good trading performance.

Apparently, RTT is one of the main important factors to pay attention to when using the software in copy trade mode.