We have already reported how our winning trading strategy part of our Smart Forex Tester Suite was consistently profitable during a month of testing on EUR/USD and GBP/USD on TrueFX live data feed.

This week (October 5-9) we tested the version1 of this strategy. We were running the test on the GBP/USD – the currency pair that showed amazing results in the monthly test, often scoring twice more pips in profit than the currency pair’s volatility.

The version1 of our automated strategy delivered similar results when tested on the same live price feed. We used exactly the same parameters an in the previous test.

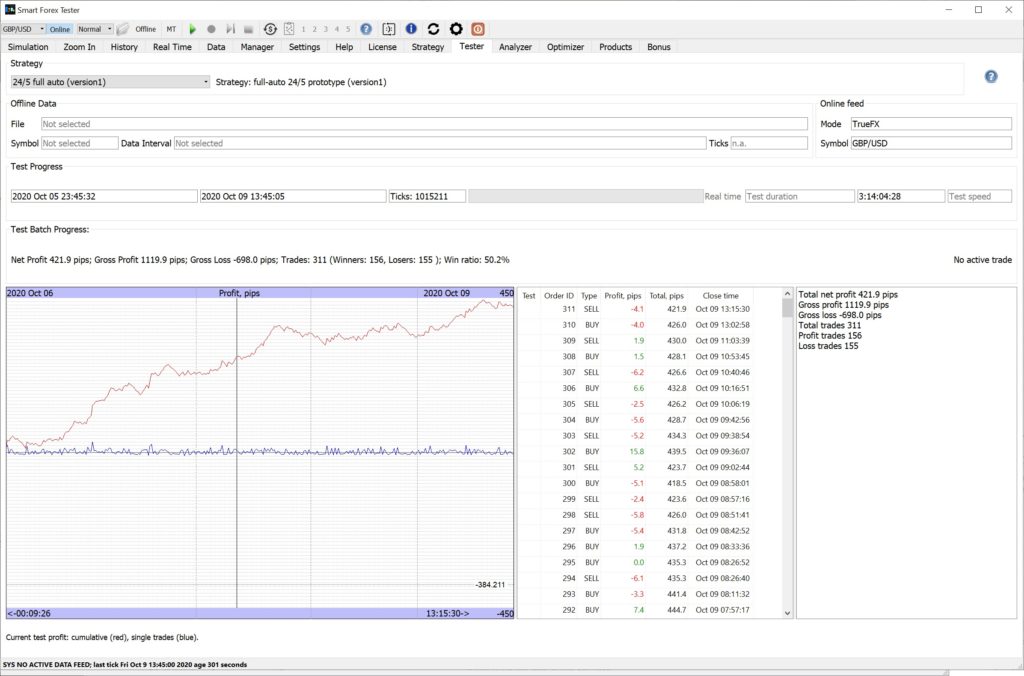

The graph shows all the trading session from Tuesday London thru Friday NY.

The strategy was on all the time. We see the same pattern as in the previous tests: solid gains on volatile UK sessions (starting at dashed vertical lines) and small losses in slow trading between the NY and UK sessions.

On Thursday’s (as well as on not shown Monday’s) session the result was about zero. In Forex this is not a bad result at all.

In addition, note that the profit curve is smooth. Our 24/5 trading strategy is designed not to allow big single losses. Also you can see that the longest losing streaks happened during the quiet Asian sessions, so in absolute figures, the draw-down was small.

The overall win ratio was 50.2%, which means that on average we were winning much more than we lose. If we paused the strategy during the Asian sessions, the win ratio would have jumped considerably: as we discussed in the previous test report, our current strategy is more suitable for trending markets.

But since we want the strategy to be universal and be able to run 24/5, in the future versions we will add the mean reversal algorithm that will be activated both by time (for Asian session) and market action (e.g. when the volatility is low and the markets are threading water).

Don’t have the Smart Forex Tester Suite yet? Get it here.